by Carol L. Nowka, CFP and James W. Gottfurcht, Ph.D.

What emotional issues or personality traits are coloring a client’s financial situation? Financial advisors often run up against client behaviors that obstruct the client’s financial success. The authors of this article—a financial planner and a psychologist—give an overview of a process they used to assess and advise one of the planner’s clients. They also discuss the benefits of consulting with a psychological therapist or counselor.

Ms. Nowka is founder and principal of Nowka/Grimes Financial, Inc., a fee-based financial advisory firm. She currently manages the Internet listserver for the Nazrudin Project. She may be reached by e-mail at nowka@hamilton.net.

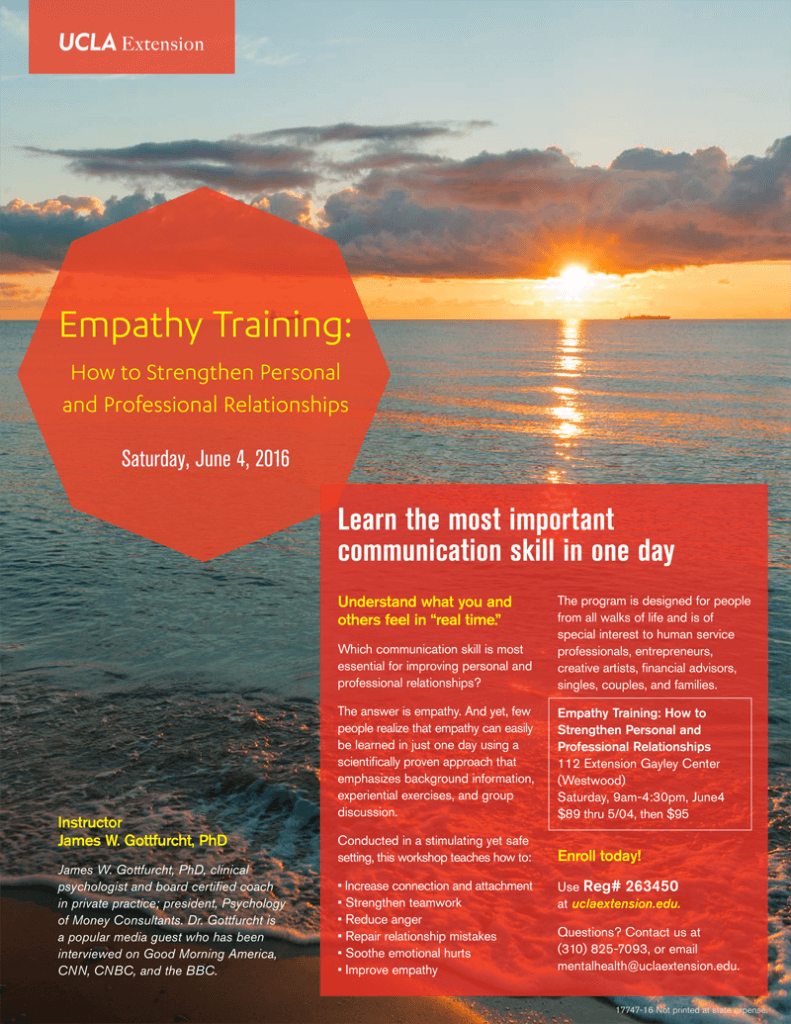

Dr. Gottfurcht is an international consultant, speaker, coach and clinical psychologist who helps financial service professionals and clients understand and overcome irrational behavior. He is president of Psychology of Money Consultants, a Los Angeles-based firm, and can be reached at (310) 828-1818.

“Fear.” That was Laura’s free-association response to the word “money.” What did it mean? How would I incorporate what I knew was an emotional issue with the major financial issues that required sensitivity? How would I involve Dr. Gottfurcht, who lives in California, thousands of miles from my practice—how would I involve him in a case that obviously needed a different type of counseling than I could provide?

But I am getting ahead of my story. This article combines my experiences with a particular client and insights from Dr. James W. Gottfurcht regarding the case.

Laura, age 42, has been a client for at least 15 years. She has been divorced from her first marriage for many years and plans to remarry—this time to Chuck.

Laura was originally referred to me by an attorney who had helped her liquidate a failing business, leaving her $20,000. She wanted to invest the balance for her only child’s education. Her son has since graduated and is mostly on his own.

I did not hear from Laura for another five years after that. Then she called to ask me to help her reorganize her debt (for another failing business). Evidently her father had given her $200,000, which equaled her debt. She wanted to know if she would be better served to pay off the debt. I counseled her that she should use the money to buy certificates of deposit (CDs) to collateralize the debt, as her corporation (along with another shareholder who had no resources of her own) owed the debt. I also indicated that she needed to re-evaluate this business and its future.

But before we could get all of the debt consolidated and arranged, Laura called to tell me her father had died unexpectedly. She was about to receive $600,000 from her father’s estate, and her mother’s estate was worth $6 million. That happened ten years ago.

In the meantime, Laura and her business partner struggled with their business difficulties, but seemed to be slowly deciding to give it up. Laura was managing to curtail the downside of the business while realizing it had very little upside. Then she met Chuck. She had known him through her business contacts, but became romantically involved about a year ago. Chuck was in the process of divorcing his third wife.

At the same time, Laura’s mother’s health had declined and her mother’s attorneys were doing some estate planning. They told Laura that she would be receiving another $5 million distribution. When Laura let me know she was going to receive more money, that she and Chuck were to be married and he had quit his job, I suggested that she have prenuptial agreements signed (this has been done) and that it was time for me to meet Chuck. I indicated to her that what was happening to them was not unlike two recent couples in our community who had won millions of dollars in a lottery—a life-altering experience! She concurred with me, and they both agreed to work with a psychologist to help them understand their psychological money skills, including their strengths, weaknesses and differences. This seemed even more important when I learned that Chuck was coming to the marriage with $40,000 debt on his credit cards.

Psychological money skills are learned behaviors that are psychological in nature and are associated with financial success factors such as realistic expectations and receptiveness to change. To be financially successful, for example, people need to have relatively realistic expectations and maintain some degree of receptiveness to change.

My concerns as a financial advisor were how to

The Psychology of Money Profile

Dr. James Gottfurcht, a Los Angeles-based consultant, speaker and clinical psychologist, developed the Psychology of Money Profile in 1982 to help assess clients’ strengths and weaknesses on ten core psychological money skills associated with financial success and peace of mind. The profile has 40 multiple-choice questions and a number of personal background information items. It takes about 20 minutes to complete and can be done at the client’s home, office or any place of choosing.

Some of the types of clients who seem to benefit the most from completing the profile are those with

If you have a client you want to understand better or who fits one of the above six types, you have a candidate a for taking a money psychology profile. Here are some questions to ask your clients to determine if they are interested in taking the profile:

If your client answers yes to one or more of these questions, he or she will perceive gaining some value-added information from the profile. The more yes answers your client gives to these questions, the more motivated he or she will be to take the profile.

There are three categories of scores clients can receive on each of the ten psychological money skills. A high score means that a client has Prosperity Thinking on that skill. Prosperity Thinking is when his or her thoughts, feelings and attitudes are aligned with realistic levels of abundance, confidence or gain. Prosperity Thinking is linked to financial success, rational behavior and peace of mind. A low score means a client has Poverty Thinking, which is when his or her thoughts, feelings and attitudes are aligned with scarcity, fear or loss. Poverty Thinking is associated with financial disappointment, irrational behavior and stress. A midrange score is when a client has a combination of Prosperity Thinking and Poverty Thinking and relates to a mixed level of financial success, rational behavior and peace of mind.

Starting the Process

At my first meeting with Chuck, I found him be a very intelligent 58-year-old man who had given much thought to his circumstances. He articulated his thoughts openly and was seemingly honest with me. He had given thought to the fact that he is dependent upon the income that he will receive from his future wife’s inheritance. He indicated that as long as they do not invade the principal of her inheritance, he could accept her income—as if she had earned her income at a job not unlike any other couple.

In the process of explaining the use of the money profile and working with Dr. Gottfurcht, I gave them Dr. Gottfurcht’s word association quiz, asking them to free- associate to the word “money” five times. Chuck’s responses were security, fun, help, equity and charity. Laura’s responses were fear, fun, cars, green and food. When I asked her why she responded with the word “fear,” she was uncertain. Chuck seemed to help her articulate her answer to be “her fear that the money could interfere with their relationship.” (I wondered later if her fear may have something to do with the grieving process at the loss of her father or because of the failed businesses.) We did not discuss Chuck’s responses much, except that he noted that they paralleled Mazlow’s hierarchy of needs theory.

After the interview, I realized that he seemed to be a real optimist who tended to let things take care of themselves, never mind the debt accumulations. His risk in this relationship is giving up his job and career path at his age.

I sent this couple home to complete their profiles. Later, we all met with Dr. Gottfurcht via telephone conference call; what follows is Dr. Gottfurcht’s summary of the most significant concerns in his assessment.

Assessing Laura and Chuck

Laura and Chuck were stimulated by hearing definitions of the ten core money skills, by learning their strengths and weaknesses, and by receiving exercises designed to overcome their Poverty Thinking. Also, they appreciated learning they had been experiencing the concept of wealth with some negativity rather than more positively as they had wanted.

Analysis of Laura’s profile provided the major finding that her low score on Realistic Expectations combined with her background information created an important vulnerability to sabotaging herself financially. More specifically:

Laura’s communications via e-mail following this meeting expressed glowing feelings of worth for the experience. Some of her comments were: “It was important to both of us to see the idea of wealth in a more ‘positive’ light. We see how our previous perspectives were indeed ‘Poverty Thinking.’ We both have had unrealistic expectations in the past, and have engaged in idealism, denial and avoidance. We think that even though we both have a tendency toward such behaviors, we have helped each other be more realistic, but we hope you will be able to help by telling us if you see us falling off the wagon together.”

Laura’s request of asking me to tell her if she and Chuck “fall off the wagon” shows awareness of how her Poverty Thinking with regard to Realistic Expectations can undermine her financial success.

After this meeting, I thought my task was completed and I could resume being simply a financial planner. A few weeks later, in my absence, my staff informed me that Laura had called to request instructions on how to change the title of her taxable Schwab account to include Chuck’s name. I said to my staff, “You’re kidding!” They had sent the applications with instructions. I knew I must call Laura to ask why she desired this action, but before I could, I received an e-mail from her asking for my opinion on the change of her account to joint ownership with Chuck so he could write checks on the account. I e-mailed her back saying that I did not think it was a good idea for now, because of the legal entanglement it could cause. Instead I suggested they start a joint bank account, and she could deposit funds to it as needed. In sending this e-mail message to her, I received another e-mail back from her telling me to disregard her previous message as she had realized that her request had defied her prenuptial agreement. Although I breathed a sigh of relief, I realized that with their scores on the money profile, I probably would always need to monitor her tendency toward financial sabotage.

Consulting with a Psychologist

The basic question of how planners can know when they will benefit from consulting with a psychologist is answered in many ways. The psychologist can…

When helping clients with the psychological aspects of their money issues, we must remember to remain sensitive and alert to the idea that some of them may need professional help from psychologists or other therapists. There are several signals clients may send to tell us they need more assistance than we are trained to give:

Furthermore, it is important to recognize that when you reach your limits, seek the professional help you need or that your client needs. If you’re working with a high-maintenance or difficult client, remind yourself in advance that a leopard can’t change its spots. If you want to keep the client, your best hope lies in changing one or more of your own behaviors to become more compatible. If you feel the client is too toxic or you do not want to change your own behavior, then it probably will be necessary to terminate the relationship.

Today’s competitive marketplace of financial services includes a proliferation of discount brokers, free research on the Internet and online trading. One way to hold or increase your market share is to offer value-added services that provide your clients with unique knowledge and guidance to increase their financial success. We hope we have stimulated your interest in this area by discussing how this particular profile and overall paradigm can propel you and your clients to your next monetary milestone.

Search for